When you’re looking to furnish your room or maybe even your whole house, Wayfair is a super popular place to shop. They have a huge selection of furniture, decor, and everything in between. But what if you’re on a budget? Maybe you’re wondering if Wayfair works with programs that help people afford things, like SNAP Finance. Let’s dive in and find out if Wayfair accepts SNAP Finance and explore some other important things to know.

Does Wayfair Directly Accept SNAP Finance?

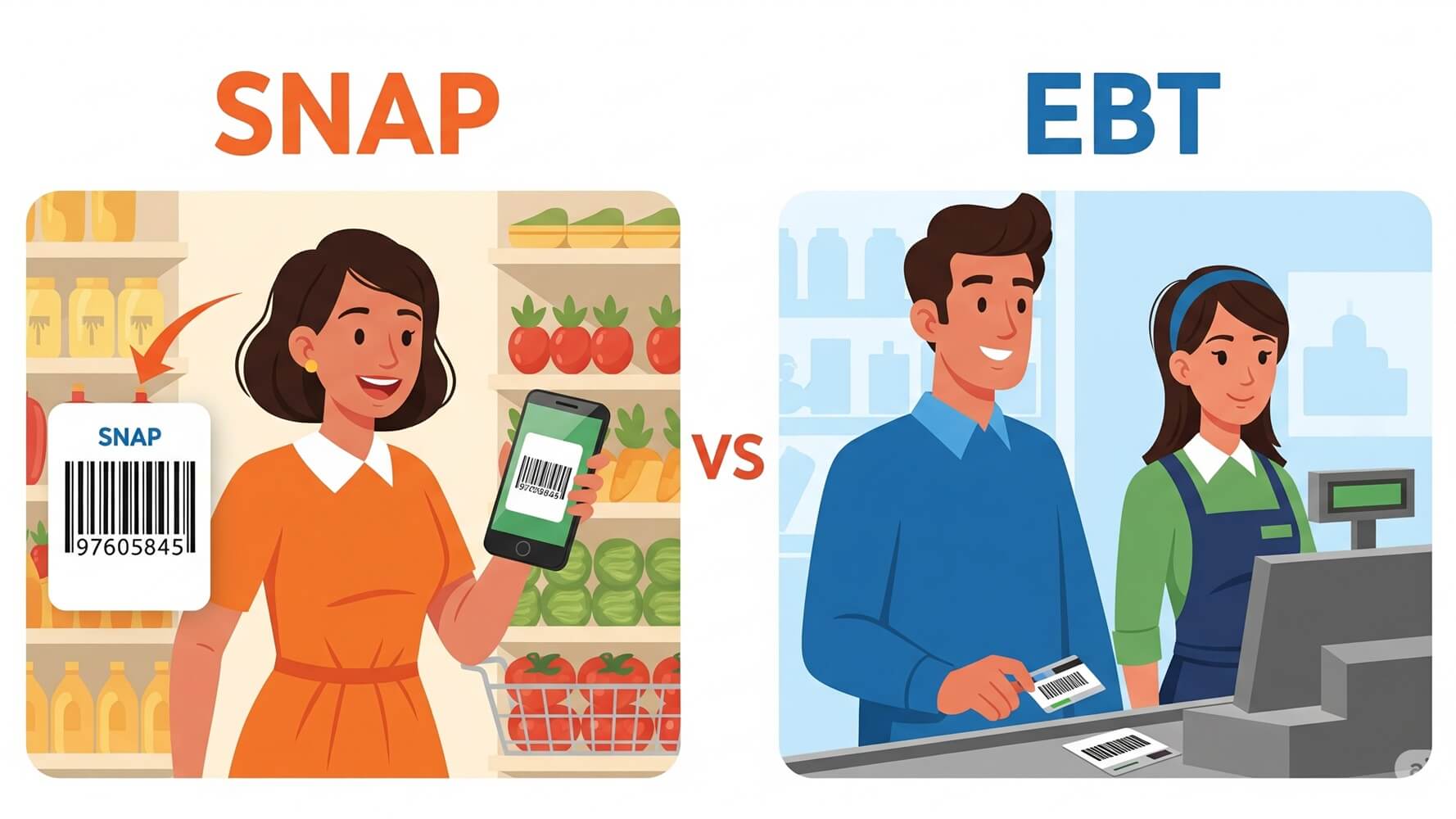

No, Wayfair does not directly accept SNAP Finance as a payment method. SNAP (Supplemental Nutrition Assistance Program) is primarily designed for food purchases, and Wayfair sells items like furniture and home goods. This means you can’t use your SNAP benefits to pay for anything on Wayfair’s website.

Alternative Payment Options at Wayfair

While SNAP isn’t an option, Wayfair offers other ways to pay for your purchases. This is helpful because sometimes you might want to spread out the cost of a big purchase. They want to make things easier for you.

Wayfair often has financing options available. These can sometimes include installment plans, where you make smaller payments over time, instead of paying everything upfront. Check their website for the most up-to-date details on the types of financing they offer. Keep in mind, these options often require you to qualify and may have interest attached. Check out what they offer for details.

You can also use a credit card or debit card. This is the most common way people pay at Wayfair. This is the same as how people would shop in stores or at other online retailers.

- Credit cards can help you build credit, if you pay on time.

- Debit cards take money directly from your bank account.

- Make sure you pay attention to your spending and stay within your budget!

Before choosing any payment option, be sure to read all the terms and conditions, including interest rates and fees.

Exploring Wayfair’s Financing Programs

Wayfair sometimes teams up with financing companies to offer special payment plans. These programs usually allow you to buy items now and pay for them later in installments. They’re a good idea, especially if you need something now, but the price is high. But remember to read the fine print!

Often, these financing programs have certain requirements, like a credit check. This means the finance company will look at your credit history to see if you’re likely to pay back the money. If you’re approved, you’ll have to follow a schedule to pay it back.

- Check the interest rates.

- Understand the payment schedule.

- Be aware of any late fees.

- Make sure you can handle the monthly payments before committing.

Pay close attention to these details so you fully understand what you’re signing up for. Getting into too much debt can cause problems.

Credit Cards and Wayfair Purchases

Using a credit card can be a convenient way to shop at Wayfair. They can offer rewards, like cashback or points, which can save you money in the long run. You can earn these rewards on every purchase!

If you have a credit card, always use it responsibly. You’ll need to pay your bill on time and avoid spending more than you can afford to pay back. Some people find this helps. It can also help build your credit history, which is important for things like renting an apartment or getting a loan later. It’s a useful skill to have!

| Pros of Credit Cards | Cons of Credit Cards |

|---|---|

| Rewards and Points | High Interest Rates |

| Build Credit History | Potential for Debt |

| Purchase Protection | Fees |

Always be mindful of your spending. Make a budget to help you make wise financial choices. Credit cards can be useful tools, but only if used carefully.

Checking for Sales and Discounts

Wayfair frequently has sales, discounts, and promotions. They can help lower the price of your furniture or home goods. Knowing when these sales happen is a great way to save some money. This is super helpful, especially if you are on a budget!

Keep an eye out for clearance items, seasonal sales (like Black Friday or holiday sales), and special offers. You can often find great deals, but you have to search for them. Many people subscribe to the email lists of stores to get the newest deals.

- Sign up for Wayfair’s email list.

- Check the “Sales” section on their website.

- Compare prices with other retailers.

- Don’t be afraid to wait for a sale.

By using these strategies, you can find the best deals on the items you want. Always think about how you can get a lower price on something.

Understanding Budgeting and Saving

Before buying anything, especially furniture, think about your budget. This means making a plan for how you’ll spend and save your money. It’s like a map that guides you through your finances.

Figure out how much money you have coming in (like from a job or allowance) and how much you spend each month (on food, entertainment, etc.). Then you can see how much you have left for things like new furniture. If you want to save a bit, think about how much you can afford to put towards your goal.

- Track your spending.

- Set financial goals.

- Create a realistic budget.

- Save regularly.

Using a budget will ensure you have enough money for the important things and allow you to make smart choices about your spending.

Comparing Prices and Shopping Smart

Before you make a purchase at Wayfair, or anywhere else, do some research. See what other places are selling the same or similar items. This will give you a good idea about the different prices and save you money.

Websites like Amazon, Overstock, and even local furniture stores could have similar items. Don’t be afraid to look around. You might find the same couch for a lower price somewhere else. Always remember to think about the quality of the items as you research, too.

- Use price comparison websites.

- Read customer reviews.

- Consider shipping costs.

- Look for coupons or discounts.

This extra research helps you make sure you’re getting the best deal. You will make smart buying decisions and get the most value for your money.

In conclusion, while Wayfair doesn’t directly accept SNAP Finance, there are other payment options available, such as financing programs and credit cards. Understanding your budget, looking for sales and discounts, and comparing prices are all helpful steps to help you afford home goods from Wayfair and other retailers. It’s always important to shop responsibly and make informed choices about your spending.